exxon stock dividends per share

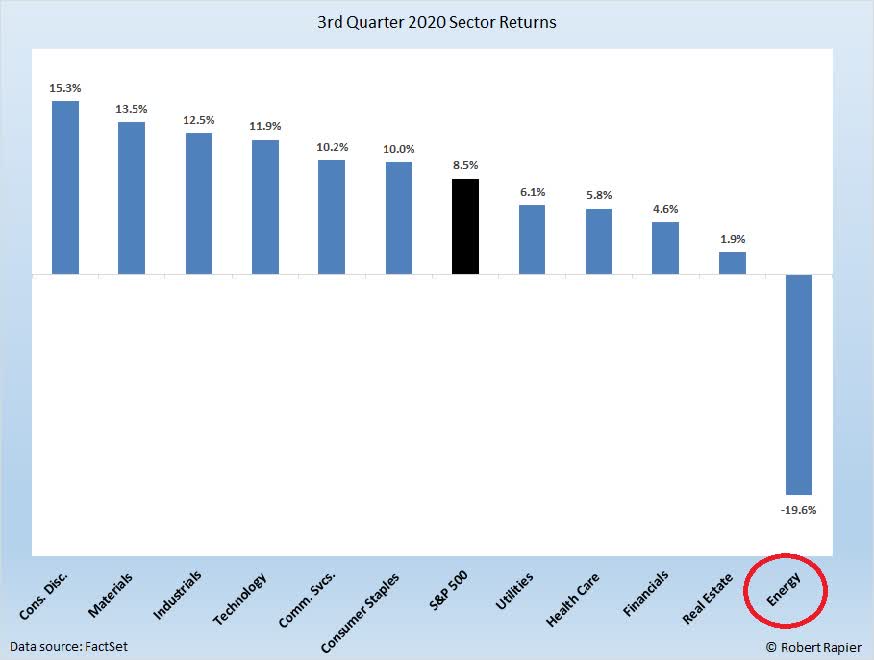

Like Exxon Mobil Shell has become an absolute cash flow machine with the rise in energy prices. These returns cover a period from January 1 1988 through August 1 2022.

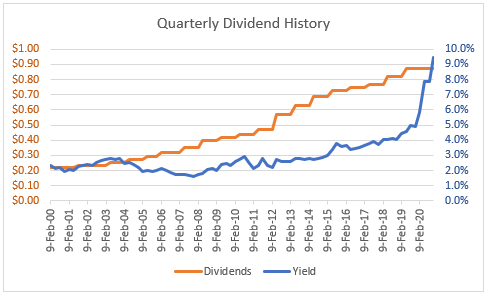

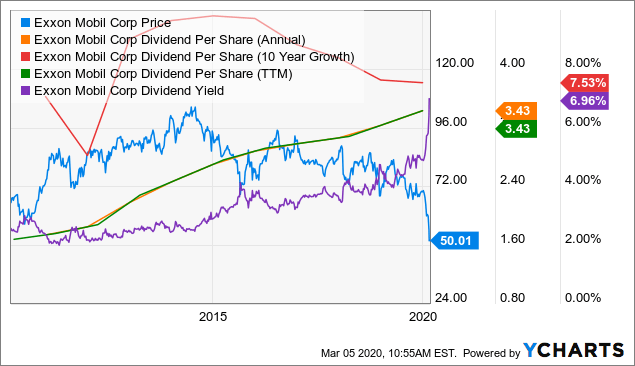

Exxon Mobil Dividend Yield Pushes Past 4

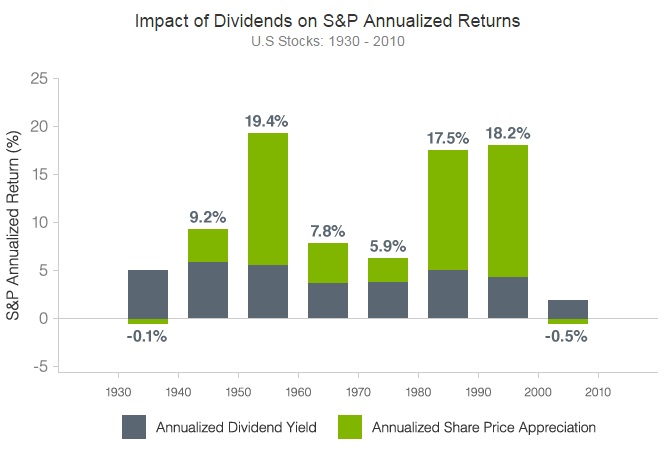

Without share price appreciation however investors would.

. Whats Happening With XOM Stock. You own 500 shares in Exxon Mobil Corporation. The 30-day yield for FGRIX is 203 and the expense ratio is relatively low at 061.

Heres an example of how you can make money from dividends. CVX Dividend data by YCharts. Exxon Mobil XOM has 5 splits in our Exxon Mobil stock split history database.

You may automatically reinvest all or part of your dividends in additional shares of ExxonMobil stock through the Computershare Investment Plan for ExxonMobil Common Stock. Capital and exploration expenditures were 46. For example a 1000 share position pre-split became a 2000 share position following the split.

The P-E ratio for Exxon Mobil is 95 X based off of EPS predictions of 1026 in FY 2023. IRVING Texas July 29 2022 Exxon Mobil Corporation today announced estimated second-quarter 2022 earnings of 179 billion or 421 per share assuming dilution. This means that you will receive a payment of 300 500 x 060 All being well you will receive an additional dividend payment in Q2 and each quarter thereon.

If the stocks closing price the day before the ex-dividend date if 50 per share that stock will be marked down to 4975 at the next days opening. Whats Happening With XOM Stock. The Board of Directors of Exxon Mobil Corporation today declared a cash dividend of 088 per share on the Common Stock payable on September 9 2022 to shareholders of record of Common Stock at the close of business on August 12 2022.

For more information on dividend payment options call. The first split for XOM took place on July 26 1976. Exxon Mobil NYSE.

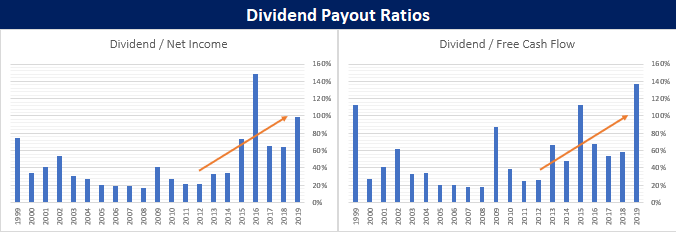

This was a 2 for 1 split meaning for each share of XOM owned pre-split the shareholder now owned 2 shares. Exxon Mobil Corporation stock MAY see around 200 USD price in up coming years. A stocks payout ratio is the amount of money the company pays per share in dividends divided by its earnings per share.

PriceEarnings Ratio is a widely used stock evaluation measure. Shell is a sin stock like Tabacco for the rest of this decade. 1-800-252-1800 within the US.

Chevron hasnt just increased dividends every year for 35 consecutive years -- its doubled its annual per share payout since 2010. There is no minimum investment to get started with this fund. Exxon Mobil is trading at 15 off its 52-week high of 105.

The effects of share repurchases on stock prices are ambiguous. Earnings estimates are rising for Exxon Mobil and the stock based on current expectations is cheap. Exxon borrowed heavily during.

Since 1988 it has more than doubled the SP 500 with an average gain of 2463 per year. With a forward annual dividend yield of 384 Exxon Mobil is a dividend king among energy firms. It produced 23 million barrels of.

Dividends are typically paid out on a per-share. Shell expects to complete its 6 billion share buyback program in. In the quarter it paid cash dividends of about 19 billion dividend yield is 359 and bought back shares worth 55 billion.

Analysts raised their quarterly profit outlook on Exxon to about 402 per share from 299 a share prior to the Friday securities filing. XOM has completed a complete ascending wave cycle from 1970 to 2020. Find the latest Exxon Mobil Corporation XOM stock quote history news and other vital information to help you with your stock trading and investing.

This third quarter dividend is at the same level as the dividend paid in the second quarter of 2022. If you buy a. The companys earnings for the second quarter soared to 115 billion up dramatically from the 5.

The share price is not sustainable without the support from attractive dividends. Between 2007 to 2016 Fried found that SP 500 firms distributed 7 trillion via buybacks and dividends or over 96 of their aggregate net income promoting claims of short-termism But during. Buying Stocks for Dividends.

Stocks in the SP 500 index with the greatest buybacks outperformed the overall SP 500 over the 10 years through July but. The true reward is sustainable dividends in region of 6 with strong FCF balance sheet to cover this return. The average price target is 11221 with a high forecast of 12500 and a low forecast of 8900The average price target represents a 1968 change from the last price of 9376.

Second-quarter results included a favorable identified item of nearly 300 million associated with the sale of the Barnett Shale Upstream assets. For a security the PriceEarnings Ratio is given by dividing the Last Sale Price by the Actual EPS Earnings Per Share. A quarterly cash dividend of 15875 per share 0396875 per each depositary share each representing a 140th interest in a share of the preferred stock on CFGs 6350 Fixed-to-Floating Rate.

So the idea to believe we will reach 30 or 40 GBP in my opinion is not realistic. With a forward annual dividend yield of 384 Exxon Mobil is a dividend king among energy firms. MSFT and Exxon Mobil XOM.

Today we are going to investigate one of the giant oil companies. Without share price appreciation however investors would. In other words this tells you the percentage of earnings.

Of which about two thirds was in the form of dividends and the remainder in share repurchases consistent with the oil giants. Fidelity Equity Income Fund. Based on 12 Wall Street analysts offering 12 month price targets for Exxon Mobil in the last 3 months.

The company reported earnings of 414 per share in the second quarter quadrupling from 114 per share a year ago. Best Fidelity Funds for Dividends High-Yield Stock Mutual Funds From Fidelity. Impulsive section of this wave cycle was between 1970 and 2014 and corrective section started at 10476 former ATH on 2014 and.

In Q1 the firm pays a dividend of 060 per share.

Will Exxonmobil Raise Its Dividend In 2019 Nasdaq

Exxon Mobil S Dividend History And Safety

Exxon Mobil Committed To Dividend Shares A Buy Nyse Xom Seeking Alpha

4 Energy Stocks With Dividends To Add To Your Buy List

Xom Dividend History Ex Date Yield For Exxon Mobil

Don T Fall For The Dividend Trap Finances Money Budgeting Money Money Saving Tips

Exxon Mobil A Valuentum Style Stock With A Hefty Dividend Yield Nyse Xom Seeking Alpha

Exxon Mobil Corp Dividend Yield

Exxon Mobil Committed To Dividend Shares A Buy Nyse Xom Seeking Alpha

What Is A Dividend Dividend Com Dividend Com

Exxon Plan On A Dividend Increase Within The Next Year Nyse Xom Seeking Alpha

Xom Dividend History Ex Date Yield For Exxon Mobil

Stocks To Buy And Hold Forever Finance Investing Dividend Investing Investing Money

Retirement Strategy Exxon Mobil And A Black Swan Seeking Alpha

Dividend Aristocrats With High Expected Eps Growth Dividend Dividend Investing Dividend Stocks

Exxon Mobil Nyse Xom Has Affirmed Its Dividend Of Us 0 87

Exxon Mobil A Top Ranked Safe Dividend Stock With 7 4 Yield Xom Nasdaq

Is It Smart To Buy Exxon Mobil Corporation Nyse Xom Before It Goes Ex Dividend